The Brutal Impact of Sanctions on the Global South

Joy Gordon

It is common to hear a certain set of claims about economic sanctions: if all the right conditions are present, sanctions can be an effective tool of global governance and foreign policy. Sanctions are supposedly a “middle route” between diplomacy and military intervention. Consequently, if they were removed from the foreign policy toolkit, then countries would employ military options more often. Harmful effects on vulnerable populations, like greater food insecurity or deterioration in health care systems, are “unintended consequences.” At the same time, it is common to hear a certain set of critiques of sanctions: sanctions actually successfully coerce the target state into compliance one-third of the time at best; and this statistic is arguably closer to five percent. Sanctions may significantly worsen the situation of the civilian population. When imposed on autocrats, sanctions often trigger increased state repression.

I will begin by providing an overview of the tremendous disparities between the Global North and South in the use of sanctions, and the economic and humanitarian impact that result from sanctions due to this disparity. I will then look at the claim that unilateral sanctions do less harm than those imposed collectively or multilaterally, and I will argue that unilateral U.S. measures in fact often function as though they were global. This occurs when sanctions are extraterritorial, as has been the case for the last three decades. But more recently, I will argue, the scope and impact of unilateral measures are expanded further through the practice of overcompliance by private actors. Specifically, I will describe how this occurs within the banking industry, showing some of the significant humanitarian consequences of this. Finally, I will argue that the various measures adopted in response to public criticism, such as humanitarian exemptions and licenses, have done little to mitigate the harm.

While claims about sanctions are often made in neutral terms, in practice, both the “success” of sanctions and the resulting humanitarian consequences demonstrate that sanctions are neither imposed nor experienced equally. Rather, sanctions are overwhelmingly a tool of wealthy and powerful nations used against nations in the Global South. This is true of unilateral or multilateral sanctions used as tools of foreign policy, and also of collective sanctions imposed by the UN Security Council (UNSC). Within the UNSC, the veto power of the five permanent members precludes the possibility of Chapter VII measures including sanctions, against the U.S., UK, France, Russia, and China, as well as their allies and client states. At the same time, UNSC sanctions are overwhelmingly imposed on countries in Africa and the Arab world, many of them among the poorest countries in the world. During the Cold War era, tit-for-tat sanctions were exchanged between superpowers, and the Arab oil embargo of the 1970s did impact the US. There are also relatively recent exceptions to this broad asymmetry, notably the sanctions imposed on Russia and the Chinese retaliatory sanctions against the U.S. But for a small Global South country to reciprocate against the U.S. or a major Western power would only be self-destructive. The broad pattern is unmistakable. As Gary Clyde Hufbauer and others note in their book Economic Sanctions Reconsidered (ESR), in the sanctions episodes over the last century,

[t]he sender’s GNP is more than 10 times greater than the target’s GNP in 80 percent of cases, and in half the cases, the ratio is greater than 100 times. These lopsided ratios reflect, on one hand, the prominence of the United States, the United Kingdom, the former Soviet Union, and recently the United Nations and the European Union as senders and, on the other hand, the small size of the countries they usually try to influence with economic sanctions. (89)

Particularly in the latter part of the twentieth century, the disparity grew considerably: the sanctioner-to-target ratio before 1985 was 45:1, and between 1985 and 2000 this ratio was 453:1. (105)

So, it is misleading to say in general terms that sanctions are a tool for foreign policy and collective governance. It would be more fully truthful to say that sanctions are overwhelmingly a tool of wealthy and powerful nations, used almost exclusively against countries that are vastly smaller and economically precarious. This is the case for sanctions regimes imposed among nations, and it is also true of sanctions imposed by the UN Security Council, the international community’s vehicle of global governance.

More specifically, sanctions are overwhelmingly a tool of the U.S. In the second half of the twentieth century, the U.S. “had a near monopoly on the aggressive use of the economic instrument to achieve its objectives.”(48-49). ESR noted that in 204 sanctions episodes from the end of World War I up through 2000, the U.S. was a sanctioner in 140 of these episodes (94-96) and has imposed sanctions with similar frequency since 2000.

Further, many of the U.S.’ unilateral measures are of such a scope that they operate as though they were globally imposed. For example, there is software made by U.S. companies that functions as the common international standard, such as Microsoft, Adobe, and Zoom. When a country is sanctioned by the U.S., it is thereby cut out of whole venues for communications, access to information, and the possibility of contributing to knowledge production. Likewise, the U.S. holds a singular role as well in the global financial system. The U.S. has the largest economy in the global system, the largest financial markets within that system, and the largest stocks of foreign assets and liabilities among the advanced countries. Moreover, the U.S. dollar is the most important currency within the global economy for trade and financial transactions. For any international bank that conducts dollar transactions, the risk of being suspended from the U.S. banking system is existential; it is known as the “death penalty.” No such bank can risk running afoul of the U.S. Treasury Department, however burdensome, unreasonable, or illegal the U.S. policies may be.

In recent years, a secondary phenomenon has emerged and greatly extended the scope of U.S. sanctions. For some time the phenomenon was referred to as a “chilling effect” and more recently has come to be referred to as “overcompliance.” Overcompliance is the result of two conditions. First, the due diligence requirements for compliance with the Treasury Department’s Office of Foreign Assets Control (OFAC) regulations are not fully explicit. For example, key terms such as “material support” are not consistently and explicitly defined, and OFAC has consistently declined to provide sufficient clarity to private actors. Second, the penalties for running afoul of U.S. sanction are severe. Most notably, BNP Paribas paid nearly $9 billion in penalties and was temporarily and partially suspended from the Federal Reserve. The result was a “chilling effect” throughout the international banking community, as the BNP case made clear that OFAC was not unwilling to impose catastrophic penalties on a major international bank. Several other banks have paid penalties that were smaller but still significant, on the order of half a billion dollars. The combination of these factors drives the risk assessment of banks globally, and they broadly arrive at similar decisions: to withdraw from entire markets that are viewed as high risk. “High risk” jurisdictions, in turn, are understood to include those countries whose banking systems are viewed as underdeveloped or for other reasons do not have rigorous procedures to thoroughly vet their customer to ensure that the banks are not serving customers who are engaged in money laundering, are on sanctions lists, or may have ties to those who are on sanctions lists. Thus, banks are seeking not only to comply with Treasury Department regulations, but in fact go well beyond them, foregoing even legal business opportunities, to minimize their risk in the face of the uncertainties surrounding OFAC’s enforcement practices and the high costs of potential enforcement.

The procedures followed by U.S. and other Western banks in complying with these “Know Your Customer” requirements are elaborate and expensive. Banks must not only learn whether a potential customer is on a list of blocked persons, but also whether the customer makes ordinary products—say, tires– that are sold to a regional distributor based in Dubai, which in turn sometimes does business with a company that resells some of these products to Iran.

They entail huge expenditures for information services and extensive investment in the training and hiring of personnel at all levels to review data about customers and determine whether a customer or a transaction appears to be risky. Not only are retail-level banks engaged in this, but correspondent banks are also exposed to penalties from OFAC if they inadvertently facilitate transnational transactions involving sanctioned persons. Thus, compliance is an expensive undertaking, and is even more so for customers and regions viewed as high risk.

However, much of the Global South is perceived as being high risk, in part because it is viewed as such by the Financial Action Task Force (FATF), the entity that sets anti-money laundering (AML) banking standards, and assesses which countries and regions are “risky” in regard to their banking practices. The major international banks then, with increasing frequency, decide that it is not worth it to have a presence in these countries or regions; and withdraw from the Global South market in large numbers. When they do so, not only do these international banks terminate direct services, but they also terminate correspondent bank relations (CBRs). Correspondent banks are intermediaries that provide an array of services, such as facilitating cross-border transactions. For example, if a customer of a local bank in Connecticut wants to send a wire transfer to Beirut, the local bank must use a correspondent bank for the international transfer. If correspondent banks perceive Beirut as high risk, it will be difficult and expensive for the local bank to find a correspondent bank to facilitate the transfer. But correspondent banks, like retail banks, are wary of the expenses of ensuring compliance for all of their transfers; and, like retail banks, they are fearful of incurring huge penalties for even inadvertent violations. Thus, correspondent banks have increasingly refused to handle transfers to areas viewed as high risk.

The aggregate outcome is deeply concerning. As a result of sanctions, there has been a massive termination of CBRs from the entire regions of Africa, the Arab world, the Caribbean, parts of Asia, and some of Latin America. The consequences of this are vast. For example, Somalia is deemed by the FATF to be a high-risk jurisdiction due to the presence of the terrorist group Al–Shabaab, among other risks. At the same time, Somalia is highly dependent on remittances from family members abroad. In 2015, remittances sent to Somalia from Somalis and their family members around the globe amounted to $1.3 billion; while Somalia’s GDP around that time was estimated at $5.9 billion. Before 2015, Somalis in the U.S. and Somali-Americans sent $215 million to Somalia annually. Many of those remittances were sent through Merchants Bank of California, a major correspondent bank for the money transfer organizations which handles these remittances. But in 2015, Merchants Bank terminated this service due to the costs and burdens of meeting US compliance requirements. This termination jeopardized some 80% of the remittances sent to Somalia from the US. The result was that money transfer organizations were sent scrambling to find replacement CBRs with little luck.

The termination of CBRs affects not only remittances, but also many of a country’s critical economic functions, such as receiving payments for exports, sending payment for imports, foreign investment, and access to capital markets. Banking services may be available only at much higher costs, or they may be terminated altogether.

Importantly, the widespread practice of terminating services or of greatly increasing their cost to compensate for the risks and expenses of compliance, we see in banking—triggered by the conditions of the risk assessment discussed earlier—are replicated in every area of trade and services with the West: shipping, insurance, sale of technology, purchase and sale of manufactured goods, investments, and so on. European companies that sell equipment for water treatment are wary of doing business with dozens of countries in the Global South, for fear that some product will end up benefitting a sanctioned government or individual. The same goes for donors, who are increasingly reluctant to contribute to relief organizations active in Syria, Somalia, Lebanon, and other countries that are under sanctions. They fear that distributing even food and water may ultimately end up benefitting a sanctioned person, and the donors may find themselves facing an expensive and intimidating inquiry by OFAC. The aggregate impact of these sanctions-produced phenomena is that economic security and economic development are compromised throughout the Global South.

At the same time, it is hard to imagine what remedies might exist that would provide effective relief for either targeted individuals, or companies navigating the risks and burdens of compliance. In principle, it is possible to challenge the language of US Treasury Department regulations for lack of clarity. In practice, however, such legal challenges are unlikely to provide much relief. Of those who are targeted as Specially Designated Nationals (SDNs)—OFAC’s “blacklist” of sanctioned persons, companies, and foundations—due process protections are available only to those who are U.S. nationals, or have substantial ties to the U.S. But hundreds or thousands of SDNs are foreign nationals who have no such ties and therefore cannot claim due process protections. These foreign nationals may be able to avail themselves of the remedies under the Administrative Procedure Act, but those efforts will almost certainly fail: the courts accord a high deference to agencies under normal circumstances and when the agency invokes national security, as typically happens with regard to sanctions, the deference becomes nearly absolute in effect. So even where an individual has been impacted by explicit, publicly issued regulations, there is little or no redress.

In regard to overcompliance, because banks are choosing to terminate correspondent relations or withdraw from markets, it is hard to even conceive of what remedies might look like. OFAC will say, with literal accuracy, that when a bank decides to withdraw from a market, that is the decision of the bank, and it is under no legal compulsion to do so. However, while banks are not literally obliged to withdraw, OFAC creates the conditions that make it commercially necessary, or close to it, to do so.

As the humanitarian situations resulting from sanctions become more dire, there has been a resulting increase in political pressure. In response, we sometimes see what I would call the “theatre of concern.” That is, new measures are announced that will ostensibly address the impact resulting from overcompliance, accompanied by language of deep concern for the civilian population, and regret for the “unintended” consequences of U.S. sanctions. We saw this, for example, in the case of Afghanistan last year, when OFAC issued broad humanitarian licenses; and more recently, last December, when OFAC issued general licenses for humanitarian goods available across all U.S. sanctions regimes. These humanitarian licenses are ostensibly intended to address the concerns of banks and other private actors, who are reluctant to participate in the sale and delivery of humanitarian goods. In reality, these licenses do little to resolve the humanitarian crises triggered, or at least worsened, by U.S. sanctions. Banks, shipping companies, and other private actors are still faced with the same set of uncertainties since the underlying sanctions legislation and regulations are still in place, including their extraterritorial reach and the uncertainties regarding their interpretation and enforcement. Sanctioned countries are still designated as high risk, so the risk analysis by private actors—which is a major driver of humanitarian consequences–remains the same. Consequently, none of the macro-trends described earlier in this piece are changed by these licenses. Likewise, these unchanged background conditions mean that general licenses for humanitarian goods are of little use to countries that are on the State Sponsors of Terrorism (SST) list. For example, an NGO based in New York that wants to ship educational supplies to Cuba or Syria will have trouble finding a bank that will facilitate this transaction because the state banking regulators prohibit banks from engaging in transactions involving countries on the SST list.

Ultimately, sanctions are brutally damaging to the Global South. In part, this is because sanctions are a tool used almost exclusively by the wealthiest countries in the world, against the poorest regions in the world. But additionally, through overcompliance, sanctions also worsen the existing economic disparities between North and South by an order of magnitude. This is accomplished by actively undermining the systems and resources—such as banking services, capital investment, and trade—upon which economic development depends. It is impossible to calculate the magnitude of the resulting human damage.

Joy Gordon is the Ignacio Ellacuría, S.J. Professor of Social Ethics at the Loyola University of Chicago Department of Philosophy, with a joint appointment in the School of Law.

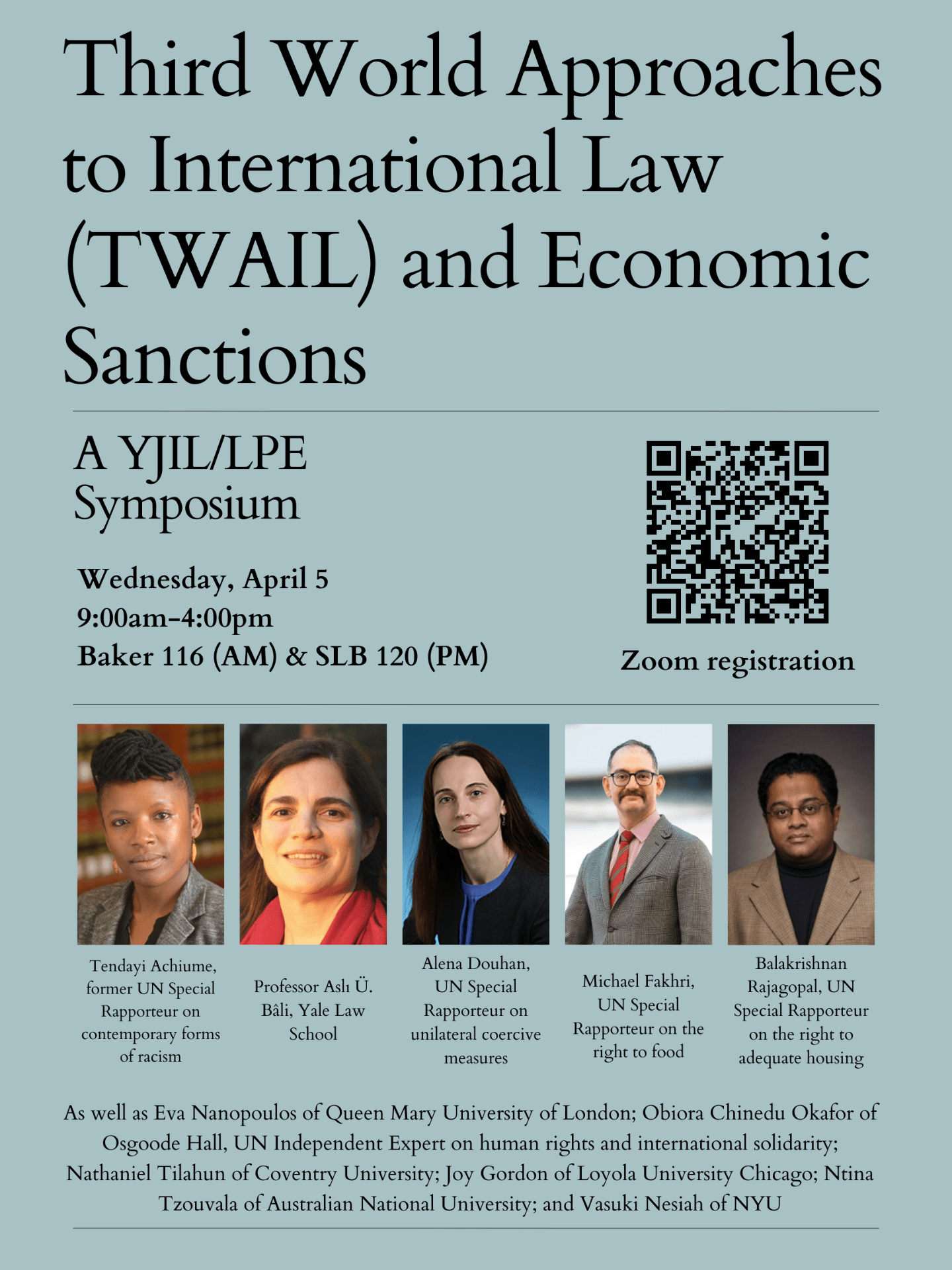

This piece is part of a Symposium on Third World Approaches to International Law & Economic Sanctions.

1 Response

[…] and the target, the more intrusive and damaging punitive economic measures can be, as Joy Gordon underscores in her post. A quick review of the states that have been targeted with the broadest packages of economic […]